The Basic Principles Of Hard Money Atlanta

Wiki Article

Hard Money Atlanta Fundamentals Explained

Table of ContentsThe Facts About Hard Money Atlanta UncoveredIndicators on Hard Money Atlanta You Need To KnowHard Money Atlanta for DummiesNot known Details About Hard Money Atlanta Not known Facts About Hard Money Atlanta

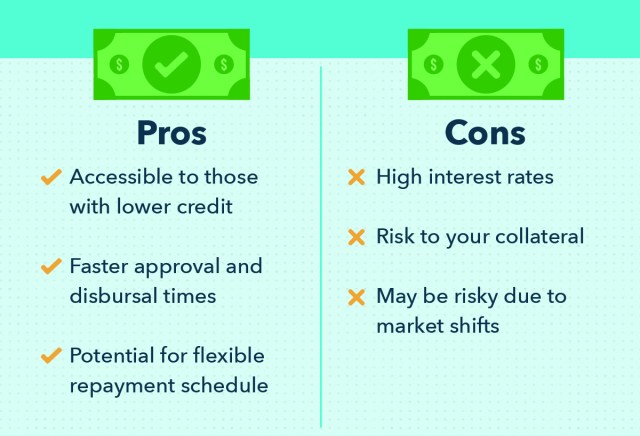

Among the biggest differences between a hard money car loan as well as a conventional loan is that hard cash loan providers utilize the value of the building versus the consumer's credit reliability to determine the car loan. This functions in favor of financiers that prepare to acquire a residence in requirement of repair services, rehab it and market it quickly for a profit on their actual estate investment. One of the most significant benefits of a tough cash lending is there are less constraints with tough money loans when.contrasting them to typical loans. This permits customers with a less than ideal credit report to acquire a funding. An additional crucial advantage of difficult cash fundings is they can be acquired quickly. Loans from banks as well as standard loan providers commonly use up to 60 days to issue, while difficult cash car loans can typically fund in a week.

Time is money in actual estate and also time is on your side with hard cash. Tough money loans also provide remarkable take advantage of for repair and also turn as well as buy and also hold investors.

Little Known Questions About Hard Money Atlanta.

Check Out Financier Lending Source to get more information, or follow them on Linked, In, Facebook, as well as Twitter. Uploaded in Exactly How To Retire Well Self Directed IRAs. This tool numbers month-to-month payments on a hard money finance, providing repayment quantities for P&I, Interest-Only and also Balloon settlements along with offering a month-to-month amortization schedule. This calculator immediately figures the balloon repayment based upon the entered car loan amortization duration. If you make interest-only repayments after that your month-to-month settlements will certainly be the interest-only payment amount below with the balloon repayment being the initial quantity borrowed.

While banks and lending institution offer commercial finances, not everybody can access them. Standard industrial home mortgages impose strict underwriting procedures that take a lengthy time to obtain approved (3 months or more). They need high credit history scores and also proof that your company has enough capital to pay back the mortgage.

If you can not safeguard a typical business financing, you can rely on difficult money loan providers. These are exclusive capitalists who provide funding based on the home you are utilizing as security. Yet exactly how do they function? In this short article, we'll speak about hard cash loan needs, its payment framework, and prices.

What are Hard Cash Financings? Unlike business car loans from financial institutions, difficult money financings are based on residential or commercial property being used as security instead than the consumer's credit reliability.

Hard Money Atlanta Can Be Fun For Everyone

This is typically considered the last option if you are unqualified for typical business funding. Economists claim hard describes the nature of the finance, which is tough to fund by typical requirements. Others say it refers to the security of the funding being a hard possession, which is the real estate residential property securing the lending.Check have a peek at this website Out Investor Funding Source to find out more, or follow them on Linked, In, Facebook, as well as Twitter. Uploaded in How To Retire Well Self Directed IRAs. This tool numbers monthly repayments on a difficult cash car loan, using settlement amounts for P&I, Interest-Only as well as Balloon settlements along with offering a monthly amortization routine. This calculator instantly figures the balloon payment based on the gone into lending amortization period. If you make interest-only repayments after that your regular monthly settlements will be the interest-only settlement quantity below with the balloon payment being the initial amount obtained.

While banks and also debt unions supply industrial financings, not every person can access them. They need high credit score ratings and proof that your firm has sufficient cash money circulation to pay off the home mortgage.

If you can not safeguard a conventional business financing, you can look to difficult money lending institutions. These are exclusive capitalists that provide funding based upon the building you are utilizing as collateral. How do they function? In this short article, we'll speak about difficult money finance demands, its repayment structure, and also rates.

A Biased View of Hard Money Atlanta

What are Tough Cash Loans? A difficult cash lending is a sort of industrial home loan given by an independent investor, such as a business or person. It is normally considered a short-term of twelve month to 3 years. But unlike commercial finances from financial institutions, tough cash finances are based upon home being utilized as collateral rather than the customer's creditworthiness.This is usually taken into consideration the last hotel if you are unqualified for standard industrial financing. Economists claim tough describes the nature of the financing, which is hard to fund by standard standards. Nevertheless, others state it describes the security of the lending being a tough possession, which is the property residential property securing the car use this link loan.

This device numbers regular monthly settlements on a hard money loan, supplying repayment quantities for P&I, Interest-Only and Balloon settlements in addition to supplying a month-to-month amortization schedule. This calculator automatically figures the balloon settlement based upon the gotten in loan amortization duration. If you make interest-only payments then your monthly settlements will certainly be the interest-only repayment quantity below with the balloon payment being the initial quantity borrowed.

While financial institutions and also credit score unions supply business car loans, not everyone can access them. They require high credit history browse around this site scores and evidence that your firm has adequate cash money circulation to pay back the mortgage.

The Only Guide to Hard Money Atlanta

If you can not secure a traditional commercial financing, you can turn to tough money loan providers. In this short article, we'll talk about hard money financing requirements, its settlement structure, as well as prices.

This is commonly thought about the last resource if you are unqualified for traditional industrial funding. Economists state difficult describes the nature of the car loan, which is tough to finance by traditional requirements. However, others state it describes the collateral of the car loan being a tough property, which is the realty property protecting the car loan.

Report this wiki page